What Makes GSB Such a Reliable Bank?

GSB has provided safe, secure banking to local Connecticut families, businesses, and commercial clients for nearly 150 years. Want to know how? Keep reading!

Year-Over-Year Growth

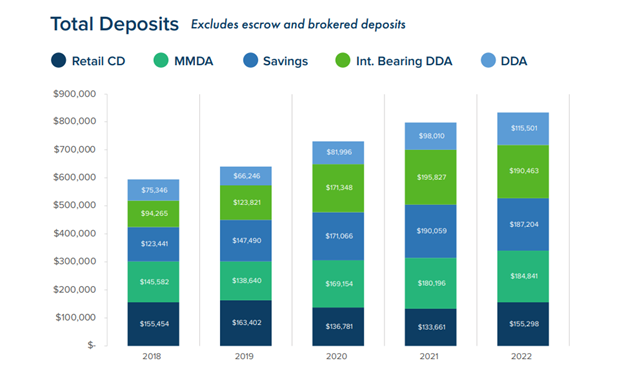

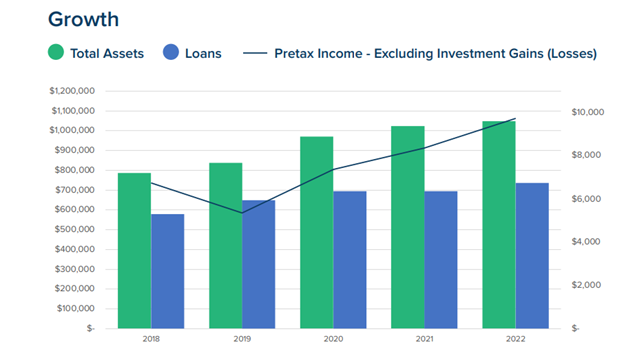

Clients place trust and confidence in GSB. Despite market turmoil caused by risky banks, GSB continues to experience deposit growth. This continues our long-term positive trend, growing stable deposits at an average annual rate 9% over the last 5 years. That’s because we adhere to a disciplined, forward-thinking, low-risk growth strategy guided by the highest principles for protecting (and improving) your financial wellbeing.

We Don't Just Grow Accounts. We Grow Relationships.

Saybrook Home President Keith Bolles talks about what brought them to GSB for their personal and business banking.

Responsible Banking Means Financial Security

Our depositor base is stable and well diversified. We don’t look for deposits from unknown or niche markets, and we don’t make larger, riskier loans to huge, faraway companies. GSB grows deposits from our neighbors across Connecticut, to small and local businesses in diversified industries. We’re not under pressure to increase our risk, unlike larger publicly held institutions that may tolerate more risk to meet shareholder demands for higher returns, which is why GSB does not rely on a small concentration of large depositors to fund our assets. If you have questions about your account’s FDIC coverage, or would like to learn more about FDIC insurance and how it works, we encourage you to contact us or access the following resources:

Understanding FDIC Deposit Insurance | FDIC Deposit Insurance FAQs

GSB is a Reliable Source of Banking Expertise in CT.

Victor Cassella, President, American Polyfilm, Inc., talks about their experience working with GSB to secure a SBA loan, and to expand their business.

We're Building on a Strong Foundation

We’ve been here nearly 150 years, and we’re not going anywhere. Our current balance sheet is stronger than most, with access to ample funding to support current and projected liquidity needs. Given our sound balance sheet and capital position, GSB has strong relationships with many funding partners. As a result, GSB has access to an abundant amount of funding should the need ever arise. Our capital allows us to meet financial obligations, borrow funds when appropriate, and absorb any losses in the rare event they occur.